It might be difficult to choose the finest vehicle insurance provider towards the end of the year. While so much is going on at the end of the year, determining who provides the greatest coverage at the best costs may be difficult. But you do not need to worry. Because our talented team has investigated the market’s best car insurance providers. We have thoroughly evaluated each company’s coverage choices, insurance rates, customer reviews, and industry ratings. Then, we trimmed the list to only the finest auto insurance providers in our analysis to make it easier for you to select the perfect car insurance company. Besides, we strongly advise you to obtain car insurance estimates from different insurers before deciding on your new car insurance provider. With that being said, keep reading the article to find the top 10 car insurance companies in 2023.

What is Car Insurance?

Car insurance is an agreement between you and the car insurance provider to safeguard you against any financial damage due to any accident or theft. The insurance provider promises to reimburse your damages as specified in your policy in exchange you will have to pay them a monthly fee.

In fact, your car insurance coverage will cover you and any other family members, whether you are driving your own car or another person’s vehicle. However, for the second case, you have to make sure that you are driving their car with their permission. Besides, your car insurance also covers you if someone else drives your car with your permission.

Moreover, your personal vehicle coverage solely covers personal driving, such as driving to work, completing chores, or going on a trip. However, I t will not protect you if you use your automobile for business purposes, such as delivering food orders.

In addition, the car insurance covers the following:

- damage or theft of your vehicle

- Medical expenses for the passengers including you in case of an accident

- Funeral costs

- Repair costs which you must not have caused. For instance, if you hit an animal by accident or if your car is damaged due to bad weather, or due to traffic accidents, the car insurance company will cover the repair costs.

Moreover, the coverage depends on different factors including the type of insurance you get for your vehicle.

Why Do You Need Car Insurance?

Auto insurance is a requirement in the majority of states by law. If you cause a car accident, the auto insurance coverage required by your car insurance policy;e0oq1x provides compensation for damages and losses. This includes the other person’s medical costs and damage to their car or other property due to the accident. Besides, it also assists in paying your legal bills if you are hauled to court as a result of the accident.

Furthermore, here are a few reasons that tell you why it is important to have car insurance.

- Car insurance is mandatory: Some states require their citizens to get auto insurance by law. Besides, they have a set minimum coverage limit too.

- It offers financial protection: If you cause an accident, there is no doubt that you will have to pay for loss and damage. However, if you have car insurance, the company will cover most of the expenses.

- Your lender may require you to have car insurance: If you are financing any vehicle, your lender may ask you to have auto insurance including collision coverage or compensation coverage.

- Helps you pay for repairs: Even if you own the vehicle, you will not have to pay for the repairs caused during an accident in case you have auto insurance.

- It helps you protect your passengers: The car insurance covers medical expenses for you and your passengers if you or any of your passengers have been injured in an accident.

Top 10 Car Insurance Companies in Australia

When it comes to your valuable possessions including life, home, or vehicle, it is essential to make sure that you have a security option. Because it is vital to make sure that you do not lose any of your valuable possessions. With that in mind, insurance seems to be one of the best options.

However, there are tons of insurance companies out there. This makes it very difficult to pick one. To help you, we have studied some of the best options and developed a list of the top 10 car insurance companies in 2023.

1. GEICO

We choose GEICO as the best car insurance provider in our list of top 10 car insurance companies in 2023 due to various reasons. The first best thing about GEICO is that it offers tons of discounts on a low premium. The GEICO car insurance offers are best for young drivers, military men, or anyone that prefers safe driving.

Besides, if someone is looking for high liability coverage limits, they should definitely check out GEICO. Moreover, GEICO makes it very easy to sign up for its services. You can choose to apply online where you will get everything from a car insurance policy to claims.

Below there are a few estimated rates for different driving profiles.

- 35-year-old with better credit and driving history: $1,352

- 24-year-old with better credit and driving history: $1,627

- 35-year-old with poor credit: $2,077

- 35-year-old with a recent accident: $2,427

- 35-year-old with recent DUI or Driving under the influence: $3,359

Pros

- Offers one of the cheapest rates among the most well-known insurance companies

- Has various coverage options

- There are better rates for students and teens

- Has the best mobile app

Cons

- Does not offer any GAP or guaranteed asset protection

- It also does not offer a great customer service

2. USAA

This insurance company enjoys a good reputation for a good reason and the highest scores in the J.D. Power 2021 U.S. Auto Claims Satisfaction Study. However, the major flaw of USAA is that it is only for military members and military families.

Thus, if you want to insure your vehicle through USAA, you need to be a military member of the US military or you have to be a family member of a military person.

According to our average percentage estimations, USAA is the cheapest company overall. The firm offers annual prices of $1,113 for full coverage insurance for safe drivers. According to our rate estimations, USAA is also reasonable for all sorts of drivers, even those with DUIs. Moreover, it offers the following rates for the different types of drivers.

Pros

- Best for travelers or living abroad

- One of the cheapest car insurance rates

- Best online customer service

Cons

- Only for U.S. military and their family members

- Has no GAP insurance

3. Progressive

Everybody is familiar with Flo, Progressive’s fictitious salesman. But did you know Progressive has a record of always staying one step ahead of the competition? This includes becoming the first to enable people to buy insurance products online even in the 1990s.

Besides, Progressive’s user system has only grown since then. Moreover, it offers features like the Name Your Price tool allowing you to commence with your preferred payment and explore the best auto insurance plans depending on your affordability.

In addition to that, Progressive distinguishes itself by being cheaper for drivers with a DUI or DWI on their records. Progressive only raise premiums by an average of 6%, whereas many vehicle insurance companies double or even treble payments.

Although it may be the best option for drivers with a history, it is worth noting that the average Progressive client spends almost $1,500 to $2,000 per year.

According to our estimations, Progressive charges excellent drivers a yearly full coverage premium of around $1,398. You will be glad to know that it is less than the national average of $1,735.

Progressive’s premiums do not rise significantly if you are a new driver. Other than that, you also need to have low credit, an accident on your record, or a DUI.

Pros

- Offers insurance budget on budget through their Name Your Price Tool

- Affordable for DUI or DWI drivers

- Offers lots of discounts

- Has injury coverage for pets

- Offers a great comparison tool

Cons

- More than the national average rate

4. American Automobile Association

Most people connect American Automobile Association with technical help. But the organization provides far more than including auto insurance. Besides, it distinguishes itself by its unequaled member perks, which include savings on insurance, automobile, bike, and security services, as well as select stores, dining establishments, rental vehicles, and more.

Despite having above 60 million users, the company’s services are locally specialized. Therefore, it is not available in all zip areas. Another thing to bear in mind is that, while the firm provides several discounts, you must be a member of AAA. But to be a member, you need an annual charge to qualify for insurance and other advantages. If you are eligible, AAA is one of the top vehicle insurance providers in the business.

Pros

- Offers a great range of discounts for its members

- Best financial strength

Cons

- You have to be a member of AAA to get insurance services.

- Not available for all area codes

- There is no insurance for rideshare.

5. Liberty Mutual

It is one of the leading auto insurance firms in the United States. Besides, it is also one of the best providers of property and liability, healthcare, and life insurance. Despite the fact that the firm was founded in the United States over a century ago, it currently has a huge international presence and works in 17 countries.

Moreover, we would recommend Liberty mutuals auto insurance provider, especially for the new drivers because it offers the greatest new driver discount among the companies we have so far analysed. In addition, it also offers an online purchase discount and a bundling discount when buying other insurance products.

Furthermore, you will be glad to know that they offer up to 30% off for good drivers.

Pros

- Available in 17 different countries

- Offers great discount, especially for young drivers

- Has a special coverage for teachers

Cons

- Has high premiums

- Its claim process ranks below average

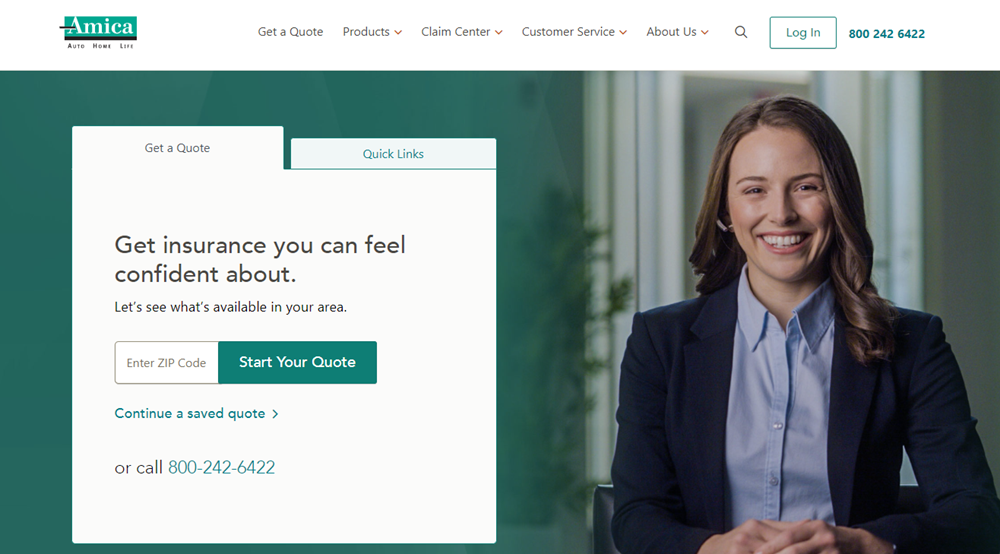

6. Amica Mutuals

It made it to our list of top 10 car insurance companies because it allows drivers to collect Advantage Points awards while lowering their deductible considerably.

Amica Platinum Choice Auto Insurance is a pre-packaged policy that provides all of the essential coverage. These are all the coverage that most consumers require. Besides, it also has special benefits like identity fraud monitoring. Moreover, It provides deductible-free glass coverage, an Advantage Points program, and rental car coverage.

Amica divides its coverage into two main categories for the drivers who wish to pick and choose. These are things you must have and things you want to have. You may tailor your plan to incorporate these extras. But bear in mind that they may result in a significant increase in your premium.

MedPay, which offers additional health insurance for bills and funeral fees, is one of the best advantages of Amica Mutuals. In addition to that, it offers collision coverage for accident-related loss and extensive collision coverage for damage caused by fire, natural catastrophes, or theft.

Furthermore, Amica offers two significant riders: a credit monitoring service and guaranteed asset protection or GAP. The credit monitoring service is in the Platinium plan of Amica whereas the guaranteed asset protection covers the “shortfall” between what you owe and the deflated worth of your automobile if it is wrecked.

Pros

- Multiple vehicle insurance

- Paperless payment, AutoPay, and upfront premium payment

- special offers for students and young drivers while taking a training program

- Offers anti-theft devices and electronic stability features

- Discounts for remaining insured for two years

- Special discounts for drivers under 30 (Only for those whose parents have Amica Insurance)

- Has a mobile app that you can use to pay bills, get roadside assistance, and more

- Offers a car connection tool that you can use to compare prices on new and old cars

Cons

- The discount may not be available in all the countries

- Prices of your insurance may be different when you buy it online vs when you get insurance on the phone.

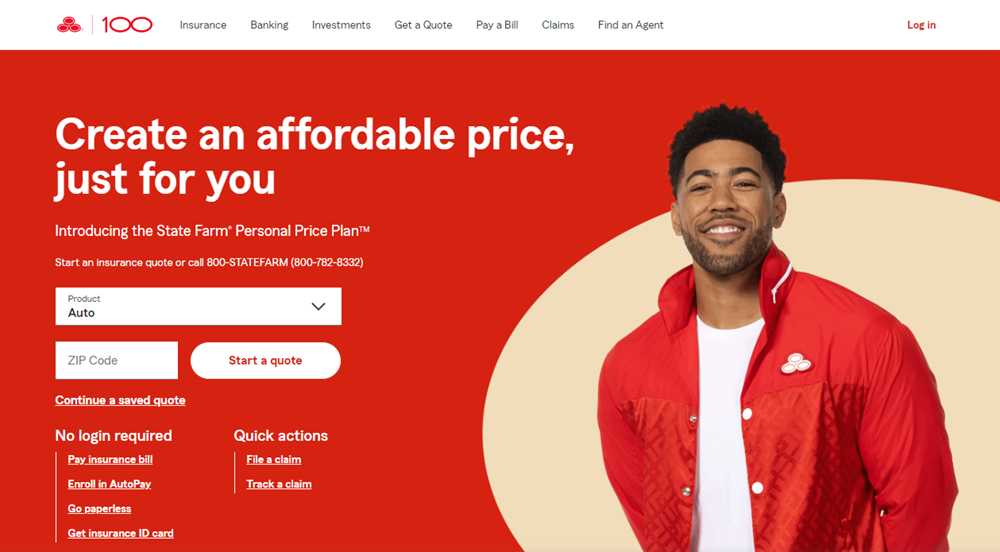

7. State Farm

We picked State Farm as one of the top 10 car insurance companies because it offers up to 25% off for teenage student drivers with a GPA of 3.0 or above.

Teenage drivers are the most costly to cover. However, State Farm distinguishes out from the competition by providing teenage drivers with substantial discounts that will cover the high rates. Moreover, Insurers can save up to 25% with the Good Student Discount if their young driver maintains a GPA of 3.0 or above until the age of 25. Besides, drivers under the age of 21 can also receive a discount by attending a driver’s education course.

Furthermore, the “Student Away at School” offer saves clients money by just covering the student when they are at home on break or on holidays.

State Farm, no doubt, is well-known for its nationwide network of over 19,000 brokers. It makes it perfect for customers who prefer more personalized service and a personal agent to whom they may address their questions.

In terms of policy, State Farm provides rental cars and travel expenses covered if you are in an accident more than 50 miles from home. Others provide roadside assistance if your car breaks down. For example, if you get a flat tire, need a kickstart, or locked your keys inside the car. On the other hand, State Farm’s travel expenses coverage includes roadside assistance if you are in an accident. And it is covered by your comprehensive collision policy.

Pros

- It offers a life insurance policy and home insurance too

- You can insurance multiple cars or vehicles

- If you are a safe driver, you may earn awards in the telematics program

- Offers defensive driving training and course but only in some of the states

- Safety features such as seatbelts and airbags for older vehicles

- A mobile app where you can pay bills, request roadside help, file claims, view ID cards, link your bank account, and much more

Cons

- Has no GAP insurance

- Discounts depend on where you live

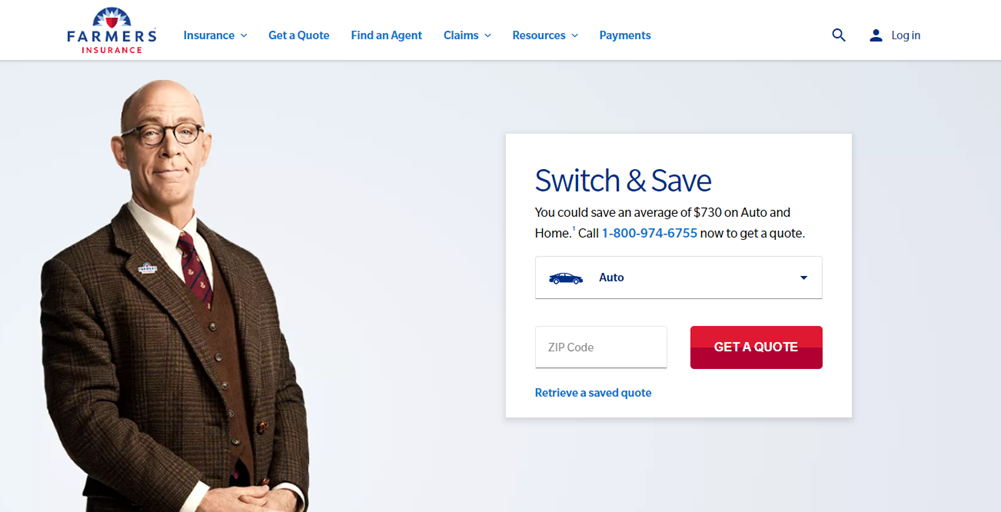

8. Farmers Insurance

Farmers is our top option in our list of top 10 car insurance companies for important employees. Because of its wide range of discounts tailored exclusively to teachers, healthcare professionals, and other first responders.

Though Farmer’s prices aren’t the lowest on the market, they are mitigated by policies and discounts that few other insurers provide. One example is its Affinity program, which provides discounts to healthcare professionals, members of specific organizations, and active, reserve, or discharged military troops.

The Senior Driver discount is another great feature that Farmers offer. It is available to those over the age of 55 or 65 who complete state-approved safe driver training. Besides, it is beneficial since elderly drivers, like young drivers, pay higher insurance costs because they are considered riskier to insure.

The Farmers provide vintage and collector automobile insurance to classic car lovers. With such coverage, you can secure your antique at the local car show or even when traveling overseas. Insurers may combine this with spare parts coverage and receive up to $750 in free spare component replacement or repair.

Moreover, the Farmers has somewhat higher-than-average rates. But its unique offers make it a wonderful alternative for individuals ready to spend a little more for customized coverage.

Pros

- Offers great discounts through SmartRide safe driving application

- A shared family car insurance

- Discounts for military members and other essential professionals

- The anti-theft and passive restraint system

- Offers one of the best paperless and automatic payments

- It has a mobile app where you can chat with your agent, get roadside help, get a quote, and much more.

- Offers motorcycle and boat insurance too

Cons

- Some discounts, such as SmartRide and SmartMiles, depend on where you live

- Accident forgiveness is not available everywhere

9. Nationwide

Nationwide was selected as the top provider of flexible plans in our list of top 10 car insurance companies. Because it provides a free annual policy assessment during which drivers may examine their coverage, ask any questions, make adjustments, and apply for reductions.

Moreover, Nationwide provides a choice of basic and supplemental coverage options. Other than that, Nationwide offers the On Your Side Review, an annual examination where customers might bring up queries about their insurance and analyze if the savings and perks still work for them. This can help drivers pick the proper coverage year after year.

Depending on your driving patterns, Nationwide provides two programs that might help you save money. SmartRide is a telematics application that monitors your driving habits using miles traveled, idle time, night driving acceleration, and braking systems. Then, it provides feedback to help you improve. Besides, signing up gets you 10% off and you may save up to 40% depending on how carefully you drive. The second program is SmartMiles, which costs a monthly base fee of $60 as well as almost a variable rate of $0.07 for each mile traveled.

Nationwide also has a Zero Deductible option. This reduction gives you $100 off your deductible for each mishap year you have, up to $500.

Pros

- You can save up to $646 by insuring your car and house simultaneously with Nationwide

- Offers anti-theft, automatic and paperless billing, defensive driving course, and much more

- Special discounts for drivers who have not had any fault accidents for almost five years

- Discounts for drivers between 16 to 24 who succeed to maintain a B average

- Offer a very easy-to-use mobile app where you can manage your insurance policies, file and track claims, coverage calculator, request roadside assistance, make payments, and much more

Cons

- It has no GAP insurance

- Does not offer accident forgiveness in CT, MA, and CA

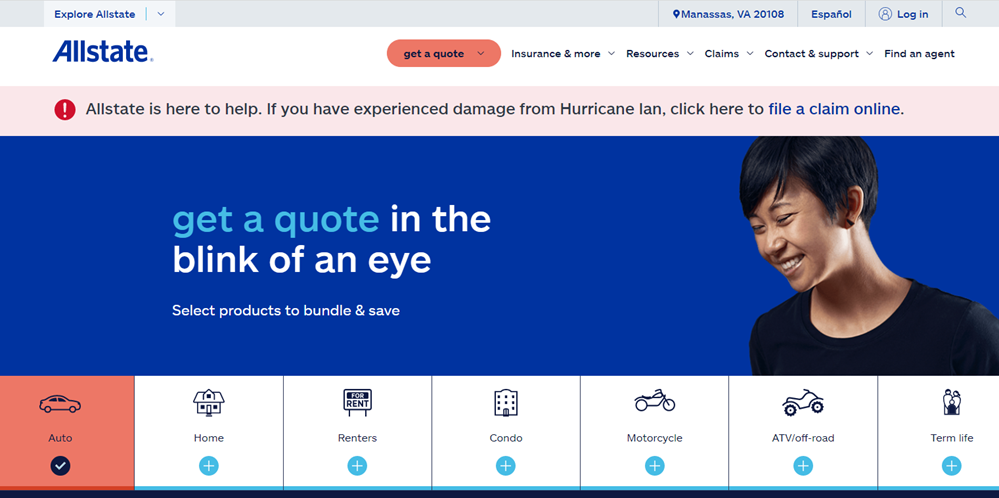

10. Allstate

We picked Allstate as one of the best auto insurance for usage-based programs in our list of top 10 car insurance companies. Because of its Drivewise telematics feature. This feature helps drivers save money by monitoring their driving, providing feedback, and awarding them for driving safely.

Nowadays, the leading vehicle insurance providers include telematics, and Allstate Drivewise is our top selection. This telematics system gives feedback on your driving habits and pays you for driving safely. Customers can receive up to 10% discount simply for joining up. Besides, you can save up to 40% when all discounts are combined.

Crash detection is one of the major safety features. It recognizes when you are in an accident, regardless of whether you’re the driver or a passenger. Besides, it gives you a notice offering to contact roadside help or police.

Pros

- It offers new equipment discounts for brand new cars.

- Other than that, it also has anti-lock brakes, anti-theft devices, automated and paperless payments, multiple policies, and more

- Offers discounts for students who stay away from home and get a driver’s program

- A mobile app where you can access your ID cards, report claims, pay bills, get accident support, and request roadside assistance

Cons

- Not available for everyone

- Offers less specialty coverage than other car insurance companies

You can read more about:

- Advantages of Online Banking for Students

- 12 Best Tips for House Buyers – 12 Important Things to Know Before Buying a Property in 2023

- Top 10 Tips for Time Management to Work Smarter, not Harder

- Why New Businesses Fail – 8 Common Reasons

- How to Write a Reflection Paper – Best Tips to Write a Reflection Paper

- Top Online Doctoral Programs in Business

- Online Business Degree – Best Online Bachelor’s Program in 2022

- How to Reduce College Costs